توضیحات

مقاله انگلیسی

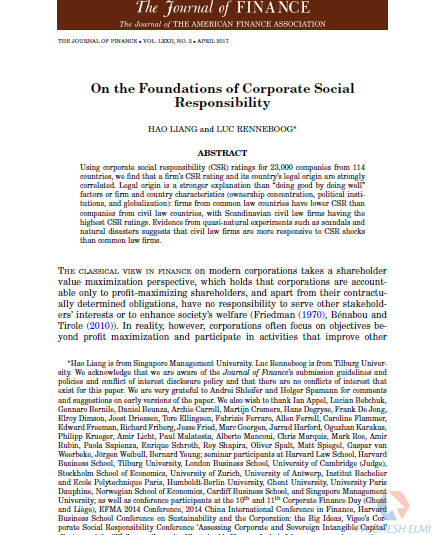

On the Foundations of Corporate Social Responsibility مبانی مسئولیت اجتماعی

مبانی مسئولیت اجتماعی شرکت

HAO LIANG and LUC RENNEBOOG

THE JOURNAL OF FINANCE • VOL. LXXII, NO. 2 • APRIL 2017

ABSTRACT

Using corporate social responsibility (CSR) ratings for 23,000 companies from 114 countries,

we find that a firm’s CSR rating and its country’s legal origin are strongly correlated.

Legal origin is a stronger explanation than “doing good by doing well” factors or firm and country characteristics

(ownership concentration, political institutions, and globalization):

firms from common law countries have lower CSR than

companies from civil law countries, with Scandinavian civil law firms having the highest CSR ratings.

Evidence from quasi-natural experiments such as scandals and

natural disasters suggests that civil law firms are more responsive to CSR shocks than common law firms.

THE CLASSICAL VIEW IN FINANCE

on modern corporations takes a shareholder value maximization perspective,

which holds that corporations are accountable only to profit-maximizing shareholders,

and apart from their contractually determined obligations, have no responsibility to serve other stakeholders’

interests or to enhance society’s welfare (Friedman (1970), B´enabou and Tirole (2010)).

In reality, however, corporations often focus on objectives beyond profit

maximization and participate in activities

that improve other stakeholders’ welfare, such as providing employee benefits,

investing in environment-friendly production processes,

selecting suppliers that avoid the use of child labor,

and organizing projects to help the poor in less-developed countries.

Indeed, corporate social responsibility (CSR),

a term frequently used to describe such stakeholder-oriented behaviors,

has increasingly become a mainstream business activity

(Kitzmueller and Shimshack (2012)).

This raises the question of why do some firms want to be socially responsible rather than

pure profit maximizers, and more importantly,

why firms in some countries engage in CSR to a greater extent than firms in other countries.

The common explanation for why companies invest in CSR is that doing

so enhances profitability and firm value,

۱ a relationship often referred to as “doing well by doing good”

(e.g., Dowell, Hart, and Yeung (2000), Orlitzky, Schmidt, and Rynes (2003), Renneboog, Ter Horst,

and Zhang (2008, 2011), Guenster et al. (2011), Deng, Kang, and Low (2013),

Flammer (2015), Krueger (2015), Dimson, Karakas¸, and Li (2015)).

نقد و بررسیها

هیچ دیدگاهی برای این محصول نوشته نشده است.