توضیحات

مقاله انگلیسی

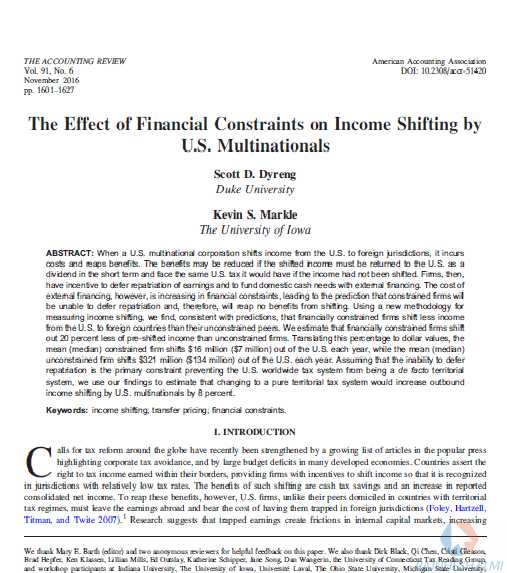

تأثیر محدودیت های مالی بر تغییر درآمد در شرکت های چند ملیتی ایالات متحده

The Effect of Financial Constraints on Income Shifting by U.S. Multinationals تأثیر محدودیت های مالی بر تغییر درآمد

Scott D. Dyreng

Duke University

Kevin S. Markle

The University of Iowa

THE ACCOUNTING REVIEW

American Accounting Association DOI: 10.2308/accr-51420

Vol. 91, No. 6 November 2016

pp. 1601–۱۶۲۷

ABSTRACT:

When a U.S. multinational corporation shifts income from the U.S. to foreign jurisdictions,

it incurs costs and reaps benefits.

The benefits may be reduced if the shifted income must be returned to the U.S. as a dividend in the short term and face the same

U.S. tax it would have if the income had not been shifted.

Firms, then, have incentive to defer repatriation of earnings and to fund domestic cash needs with external financing.

The cost of

external financing, however, is increasing in financial constraints, leading to the prediction that constrained firms will be unable to defer repatriation and, therefore, will reap no benefits from shifting.

Using a new methodology for measuring income shifting, we find, consistent with predictions, that financially constrained firms shift less income

from the U.S. to foreign countries than their unconstrained peers.

We estimate that financially constrained firms shift out 20 percent less of pre-shifted income than unconstrained firms.

Translating this percentage to dollar values, the mean (median) constrained firm shifts $16 million ($7 million) out of the U.S. each year, while the mean (median) unconstrained firm shifts $321 million ($134 million) out of the U.S. each year.

Assuming that the inability to defer repatriation is the primary constraint preventing the U.S.

worldwide tax system from being a de facto territorial system,

we use our findings to estimate that changing to a pure territorial tax system would increase outbound income shifting by U.S. multinationals by 8 percent.

Keywords:

income shifting;

transfer pricing;

financial constraints.

I. INTRODUCTION

Calls for tax reform around the globe have recently been strengthened by a growing list of articles in the popular press highlighting corporate tax avoidance, and by large budget deficits in many developed economies.

Countries assert the right to tax income earned within their borders,

providing firms with incentives to shift income so that it is recognized in jurisdictions with relatively low tax rates.

The benefits of such shifting are cash tax savings and an increase in reported consolidated net income.

To reap these benefits, however, U.S. firms, unlike their peers domiciled in countries with territorial tax regimes,

must leave the earnings abroad and bear the cost of having them trapped in foreign jurisdictions (Foley, Hartzell, Titman, and Twite 2007).

نقد و بررسیها

هیچ دیدگاهی برای این محصول نوشته نشده است.